Confident Cabinet Makers Look at CNC Upgrades or Additions in 2021

January 5, 2021 | admin

By: Amanda Conger

CHICAGO – In the Cabinet Makers Association 2020 CMA Benchmark Survey of North American cabinet shops, business owners say they expect to expand their use of technology like CNC machines, with 10% planning on upgrading or buying a second machine.

Overall, cabinet makers express confidence about their ability to navigate uncharted terrain that lies ahead. Why? Because they have done it before, facing and beating back challenges like the 2008 housing crash, cyclical recessions, even the onslaught of IKEA and DIY’ers at Home Depot.

The survey covers some business data, such as revenues and hourly rates, based on 2019 results, before the pandemic hit. While the 2020 CMA Benchmark Survey doesn’t explicitly ask about the impact of COVID-19, respondents cited it frequently in answering questions about business trends and expectations.

In forecasting future prospects, and assessing current business conditions, the pandemic is a significant factor. But cabinet makers do not take a pessimistic view. While some shop owners are on edge – wondering what their next steps will be – others say they have already weathered the worst of the pandemic by quickly adapting to its challenges.

The CMA conducts this survey annually in the U.S. and Canada, in conjunction with FDMC magazine and Woodworking Network. Designed to establish benchmarks, a wide range of subjects is reviewed – business outlook, staffing and compensation, hourly shop rates, CNC automation, construction methods, and marketing. On the demographic side, the survey paints a portrait of where shops are located, how many employees they have, how big the shops are, and what kind of work they do.

The entire industry – not only CMA members – is invited to participate. Conducted in 2020, less than half of respondents were CMA members. Interestingly, though, the collective profile of those surveyed closely matches that of a typical CMA member.

Responses were accepted only from those where were “owner, officer, or senior management” or “all of the above” (since small shop owners wear many hats).

- Most of the shops were in the U.S.

- A majority measure less than 5,000 sq. ft.

- Most shops have five employees or fewer.

- Over half have been in business more than 20 years.

Adapting to Changing Markets

Cabinet makers rely on word of mouth for marketing. These days that is as likely to be communicated on Yelp or Facebook as over the back yard fence. One respondent said that his business is strong despite COVID-19, because its reputation over the past 30+ years has kept it busy with a backlog of repeat customers.

Another respondent credited his adaptability and close-to-the-bone budgeting for his firm’s longevity, noting his business has “morphed several times over 20 years.”

“The business plan was to keep the overhead down or at least manageable because at any moment the markets tank and rise,” he said. “You just have to be flexible to stretch with it.”

Thriving Residential Work

The majority of respondents to the CMA Benchmark Survey serve customers within a 100-mile radius with a mix of commercial and residential work. Unfortunately, due to COVID-19, commercial work – projects for restaurants, hotels, and offices – has been “handcuffed” as one respondent commented.

But residential remodeling has thrived because of the increase in remodeling projects for people locked-down or working from home. As one respondent noted, “Despite COVID concerns in 2020, we are set to more than double our revenue from 2019. I think the future of the custom cabinet industry will focus more on ultra-custom work.”

For residential projects, the work is no longer just kitchens – it’s evenly distributed in every room in the house, plus the garage and outdoor living spaces, too. As in previous years, nearly all respondents market their products and services via word of mouth and referrals. As one noted, “Our business is very healthy and we have enough business that we actually turn down jobs. Since 2004 all we have been doing is from word of mouth.” However, an increasing number (48%) of small shops are using digital marketing as an effective strategy in addition to referrals.

Automation in Small Shops

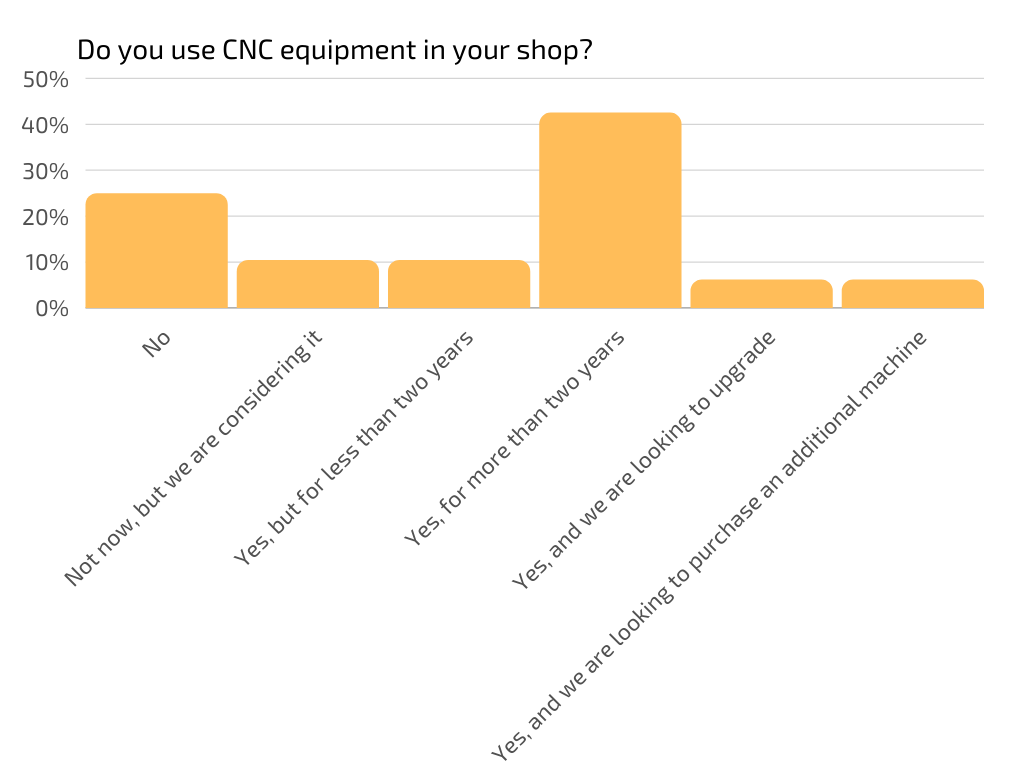

More than half of those who participated in the CMA Benchmark Survey have CNC equipment in their shops, while another 12% are considering upgrading or purchasing an additional machine. Some 10% of those who do not currently have CNC are considering investing in the technology.

Of those who use CNC, 75% say they have added significant manufacturing capacity as a result. A small percentage are still learning how to harness their CNC and secure jobs that require it. CNC manufacturing has also increased profits for the large majority of the respondents.

Pricing and Compensation

Compensation is typically the most useful data garnered from the survey results. For each level of experience (entry-level, proficient and advanced), the responses are provided for the typical job types, including designer, estimator, cabinetmaker, finisher, installer and even management positions. The data also contains details about the average annual earnings for the shop owner, which range from $50,000 to over $200,000. The billable hourly shop rate varied quite a bit among respondents, from $25 to more than $125/hour with 40% in the $51-$75 range. The details are available in the full survey results.

Cabinet Shop Industry Health

In 2019, business was strong for the overwhelming majority of cabinet shops, with 50% stating that sales were better than 2018, while 36% said they were about the same and 12% reported they were less. At the time of the survey, projections for how 2020 sales would end up were fairly evenly distributed in all three categories, primarily due to COVID-19 and the worldwide economic impact.

One respondent summed up the current situation very appropriately: “I have a belief that there will always be a need for a good cabinet maker. The economy will go up and down, and we don’t have control of it so we need to make good business decisions along the way.”

Another asserted, “Small manufacturers can compete with large companies if they are willing to work together in a network and make minor changes to their manufacturing processes.”

The world is changing more rapidly than ever, and the impact on small shops is profound. Those that emerge successfully will have confident, courageous leadership – leadership that is wise enough to take an unflinching look at the past and then make gutsy, difficult decisions about the future based on facts, not fear. This is the value of organizations like the Cabinet Makers Association – collectively we can weather the current climate and be prepared for what lies ahead.

This is only a brief overview of the survey results for the CMA’s 2020 Benchmark Survey. Other topics covered include cabinet assembly methods, construction types (frameless vs. face frame), raw material usage, plus the breakdown of those who finish their cabinets and who installs what they make.

All participants receive a copy of the full survey data. If you did not participate and are interested in diving deeper into the data, you can order the results for $39.99. Visit cabinetmakers.org/benchmark-survey for more information.

Amanda Conger has long been involved in the woodworking industry and is the executive director of the Cabinet Makers Association. The Cabinet Makers Association has been serving the needs of small to medium-size cabinet shops and other woodworking operations since 1998. The organization offers a wide range of networking opportunities and other benefits. For more information, visit cabinetmakers.org or contact Amanda Conger at director@cabinetmakers.org.

Apply to Exhibit

Grow your business at the premier global woodworking trade show.

Show Hours & Location

International Woodworking Fair

Tuesday–Friday

August 6–9, 2024

Tuesday–Thursday

8:30 AM–5:00 PM*

Friday

8:30 AM–2:00 PM*

*Building A opens 7:30 AM Tue-Fri

Georgia World Congress Center

285 Andrew Young International Blvd

Atlanta, GA 30313